|

|

|

Sclerotherapy treatment of abnormal veins is the injection of a medication into the veins, which irritates them and causes them to stick together.Read more |

|

|

|

Ultrasound guided foam sclerotherapy is a method used to treat larger varicose veins when the main branches (that can only be seen with ultrasound) are the source of the visible varicose veins. In...Read more |

|

|

|

Endovenous laser treatment treats varicose veins using an optical fiber that is inserted into the vein to be treated, and laser light, normally in the infrared portion of the spectrum, shines into...Read more |

|

|

|

The CoolSculpting procedure is the world's #1 non-invasive fat-reduction procedure.Read more |

|

|

|

Laser hair removal is a non-surgical, non-invasive method of removing unwanted hair.Read more |

|

|

|

Infini RF is a minimally invasive treatment that reduces the appearance of scarring, sun damage, acne scars, is a wrinkle and sagging skin killer, all with no risk of hyperpigmentation.Read more |

|

|

|

Infini regenerates the treated tissues using a combination of micro-injuries and radiofrequency-stimulated heat to trigger the body into releasing collagen and elastin.Read more |

|

|

|

This treatment is used to soften fine lines and wrinkles, improve the tone and texture of their skin and decrease pore size. Read more |

|

|

|

Medical lasers use a beam of light to significantly lighten or completely remove your tattoo. When the ink particles absorb the light from the laser, they are broken up into fragments and then...Read more |

|

|

|

A chemical peel is a treatment to improve the look of the skin. Read more |

|

|

|

IPL stands for intense pulsed light. It’s a type of light therapy used to treat wrinkles, spots, and unwanted hair.

Read more |

|

|

|

Levulan Photo Dynamic Therapy is a treatment method for certain skin conditions.Read more |

|

|

|

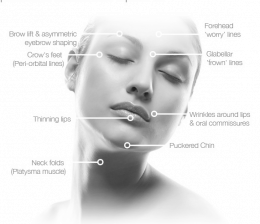

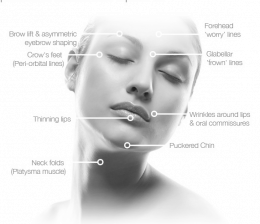

Botox is a simple, non-surgical, physician-administered treatment that can temporarily smooth moderate to severe frown lines, crows feet and more.Read more |

|

|

|

Dermal fillers are used to correct deep folds, wrinkles, superficial lines as well as used to shape facial contours and enhance lipsRead more |

|

|

|

LED is great for reducing the appearance of fine lines and wrinkles, improving uneven skin tone, reducing pores size, and brightening the skin.Read more |